Planned Giving

What is Planned Giving?

Planned Giving is a way to support Carleton College in the future through arrangements you make today.

Making charitable contributions is an art — a creative process that adapts to your changing needs as a donor. Planned giving allows you to make charitable gifts, continue to meet your current income needs, and take advantage of current tax incentives.

Ways to Give

Not only do you have options for how your gift will be used, you also have options on what to give and how to give. There are gifts that cost you nothing now, gifts that pay you income, and gifts that allow you to decide what happens when.

Tools and Resources

We want to ensure you have everything you need to make the giving decision that’s best for you. Get started with resources that will help you calculate your payments, draft sample language for your attorney, and find information for financial advisors.

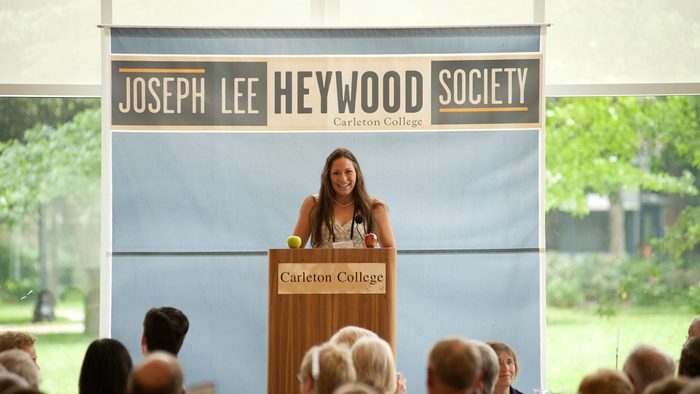

Heywood Society

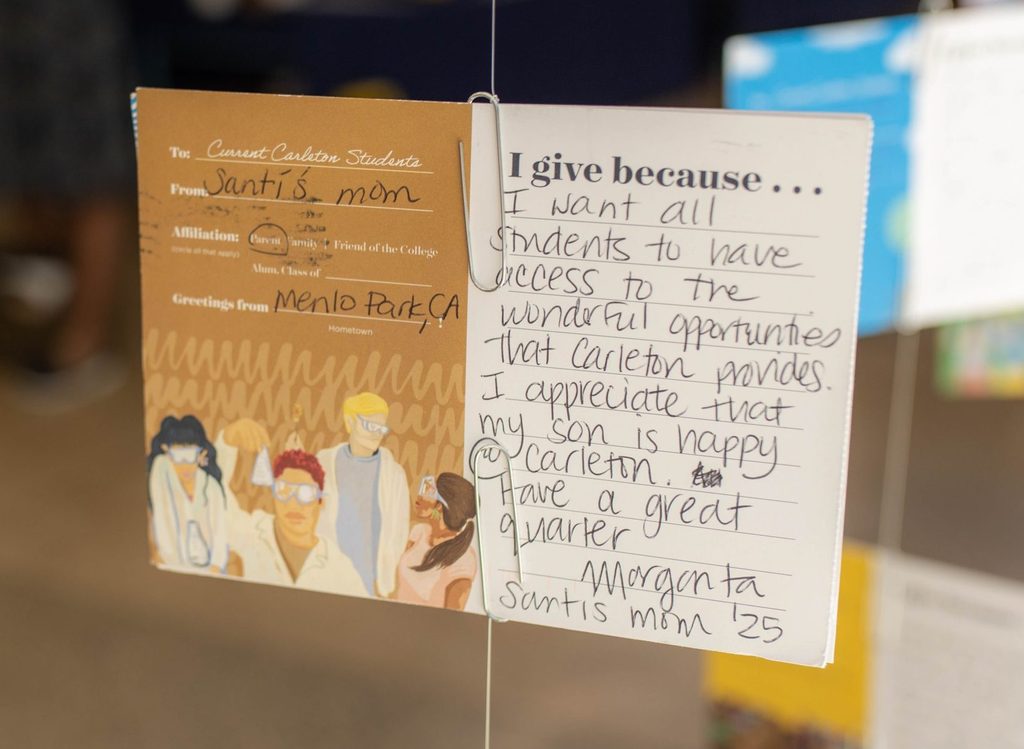

Carleton recognizes alumni, parents, and friends who have made deferred gifts to benefit the College through membership in the Joseph Lee Heywood Society. Anyone can join the Heywood Society. It is easy to do, does not have to alter your current lifestyle, and can be modified to address your changing needs.